“Blockchain” and “cryptocurrency” are hot buzzwords often used in tandem. Yet even the tech-savvy conflate these technologies. So let’s unpack the difference and get back to the basics.

Guest post by ZenLedger

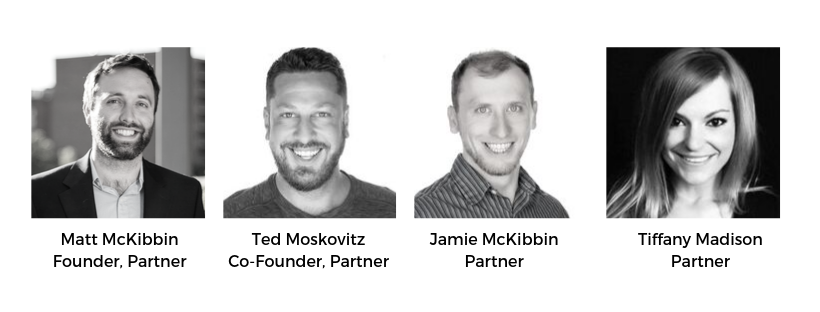

Our DecentraNet team has been in the blockchain and cryptocurrency space since 2014. As professional advisors in the space for over two years, we answer questions about cryptocurrencies and blockchain technology on a daily basis. We generally deal with tech-savvy business leaders, developers, and entrepreneurs, but many still don’t understand the basic fundamentals and differences between blockchain and “crypto”. Unlike some of the more technical explanations, we thought this article did a solid job of explaining the differences in terms anyone can understand (full disclosure: ZenLedger is a portfolio company).

Blockchain technology and cryptocurrencies are related, but they are far from the same thing — here are the differences.

Cryptocurrencies have become immensely popular over the past decade with the dramatic rise in the value of Bitcoin. At the same time, blockchain technology has been heralded as transformative for a wide range of industries, ranging from banking to the sharing economy. These two technologies are related, but they’re far from the same.

Let’s take a look at blockchain technology, cryptocurrency and what makes them different from each other.

What is Blockchain?

A blockchain is a series of immutable records, or blocks, that are time-stamped and shared across a network. Each new block contains a cryptographic hash of the prior block to form a chain. While the process of verifying a block can be resource-intensive, once it’s verified it’s easy for anyone on the network to double-check the accuracy.

There are several unique benefits to this approach:

- Decentralized — There is no core authority that dictates the truth to other participants in a network. Everyone has access to transaction history and can confirm new transactions.

- Transparent — The blockchain hides a person’s real identity, but anyone can trace every public transaction by a public address (e.g. a public cryptographic key).

- Immutable — Transactions are tamper-proof thanks to the hashing algorithm used to create and verify transactions. There’s little risk of the data integrity being compromised.

- Encrypted — Data is cryptographically stored inside the blockchain, which means that it’s secure from prying eyes. Only the sender and receiver can read the contents.

The blockchain’s properties make it appealing for many different use cases. While the most popular has been cryptocurrency, the technology is already starting to be put to use in everything from raising capital to governance to file storage — and that’s just scratching the surface of what’s possible with the underlying technology.

In addition to public blockchain applications, private blockchains have the potential to provide value to internal networks. Corporations can use private blockchains to securely store their data across thousands of computers, which could help prevent data loss, simplify audits and convey a wide array of other benefits that conventional technologies lack.

What Are Cryptocurrencies?

A cryptocurrency is a digital asset that’s designed to function as a medium of exchange using blockchain technology to securely record transactions. While Bitcoin is the oldest and most popular cryptocurrency, more than 4,000 altcoins have been introduced since its launch in 2009. These cryptocurrencies have experienced varying levels of success.

Cryptocurrency is created by validating transactions on the blockchain, known as proof-of-work mining, which has the side effect of decreasing transaction fees. Some cryptocurrencies use newer proof-of-stake methods that involve users putting up collateral to verify transactions, while others use a combination of the two approaches.

Most people store cryptocurrency in wallets or on exchanges. Wallets store public and private keys or addresses that can be used to send or receive cryptocurrency. The private key makes it possible to write to the public ledger, while the public key is used by others to send funds to the wallet. Exchanges permit users to buy, sell or exchange cryptocurrency and fiat currency.

There are many different use cases for cryptocurrencies. While the original intent was to reduce online transaction fees, the biggest purchasers of cryptocurrency have been investors looking for alternative asset classes and speculators. These dynamics have fueled the rise of Bitcoin, while Ethereum and other altcoins have gained traction over the past several years.

In short: Blockchain is the technology that enables the existence of cryptocurrency (among other things). A cryptocurrency is a medium of exchange, such as the US dollar, but is digital and uses encryption techniques to control the creation of monetary units and to verify the transfer of funds. So consider that cryptocurrency is a tool whereas Blockchain is the network to make the transaction happen. — Blockchain WTF

Adoption of the Technologies

Cryptocurrencies have faced many hurdles to widespread adoption. Many institutional investors have questioned the value of cryptocurrencies as an asset, governments have limited their utility as a medium of exchange, activists have been critical of their significant resource usage and many cryptocurrencies have experienced security issues.

Despite these concerns, there’s evidence that things are starting to change. Governments have promised to provide greater clarity to cryptocurrency users and new exchange-traded funds (ETFs) have made it easier for traditional investors to gain exposure to the asset. ZenLedger and other applications also make it easy to remain compliant with authorities.

Blockchain technology has also moved into the mainstream. According to PwC, more than 80 percent of organizations in its 2018 survey of 600 executives from 15 territories indicated they have at least some involvement with the blockchain, such as a proof-of-concept or experiment in the lab, although only about 15 percent of companies had anything live.

The most significant near-term applications could be a combination of the two. For example, JPMorgan Chase announced plans earlier this year to launch its own digital coins, called JPM Coin, that would enable customers to instantly transfer payments over a blockchain network. The goal is to reduce transaction costs while pegging the coins to the U.S. dollar.

In the end, there’s little doubt that these technologies will continue to capture market share given their advantages over the status quo, but the pace of adoption could vary based on the government’s regulatory approach and the emerging ecosystems that develop surrounding them.

From Data-Driven Investor, here’s another easy way to think about the difference:

“Imagine you’re in a casino. You enter the building and exchange your cash for chips. You can use these chips to gamble at the casino, but outside the building, they have no legitimate purchasing power.

In this example, the casino chips are cryptocurrency coins, and the casino is the blockchain network providing an ecosystem of participants and putting coins into play and allowing them to be transacted.”

The Bottom Line

Both cryptocurrency and blockchain technology has the potential to disrupt the status quo, but they are far from the same thing. Cryptocurrencies are just a single application of blockchain technology, although some would argue that it’s the biggest potential application. One of the biggest hurdles for cryptocurrency adoption remains government regulation.

You can read more about ZenLedger here.

Want to Know More About All the Awesome Stuff We Do?

DecentraNet is a purpose-driven investment and advisory firm specializing in blockchain and other transformational technologies with global impact. We also create event experiences and innovative content to bring our clients projects to market and to evangelize the potential of transformational technologies generally.

- Click HERE for instant access to our 2019 Market Report. Explore what 30 thought-leaders from dozens of industry verticals had to say.

- We are advisors and consultants that work with blockchain companies and other transformational technology projects. If you’d like to connect with us on how we can help your company, please click HERE or send us an email at hello@decentranet.com.

- You can also reach out to inquire about any of our current clients or portfolio companies at hello@decentranet.com.