After news of the largest bank in the US, JPMorgan, launching a cryptocurrency of its own, bitcoin and other cryptocurrencies are back in the spotlight. Though traders and investors won’t be able to actually purchase the newly minted JPM Coin, it brings to light one of the most important questions in the cryptosphere: usability.

There won’t be any speculative investing in the JPM Coin. Rather, the bank is testing blockchain technology for moving vast amounts of money internationally — something JPMorgan does a lot with an estimated $2-$5 trillion transferred every day. Intended to improve upon the current SWIFT network used by global banks today, JPMorgan is leveraging blockchain-based JPM Coin to enhance its own business. However, as many in the cryptosphere have pointed out, there are many ways that JPM Coin isn’t really a cryptocurrency being wholly centralized, tied to the USD, and not for individual use.

So then what about other “real” cryptocurrencies that aren’t created by a bank? This latest development raises more questions on cryptocurrency usability and, as it turns out, there are already real-world examples of them in action today. One of the ways they’re being used is to help mitigate bad centralized currencies in places like Venezuela, here’s how.

Venezuelan Crisis

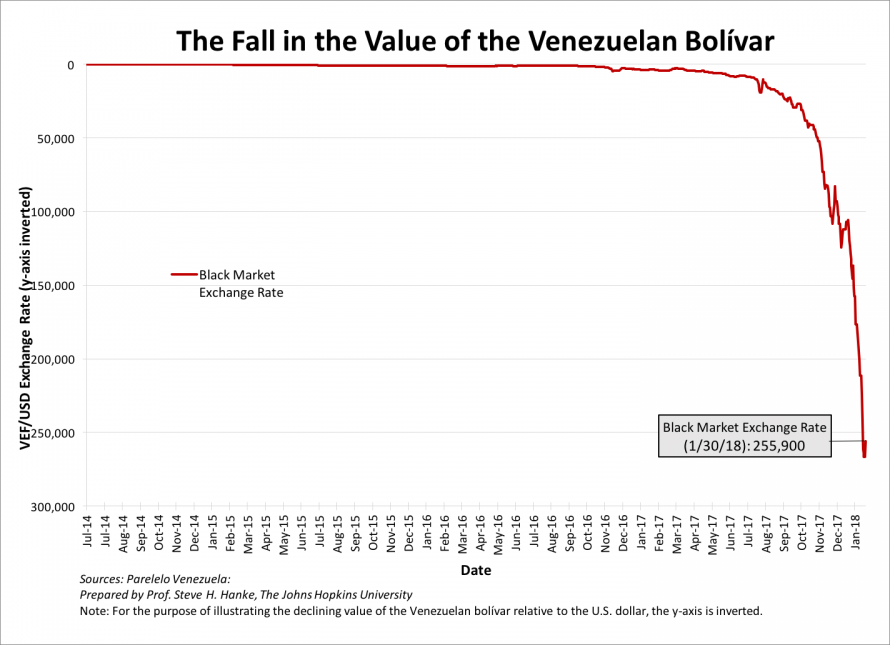

According to a recent estimate from the United Nations, more than 3 million people have fled Venezuela since 2015 amid the current economic and political crisis. While violence is still a problem in the country, one of the other pressing concerns for many is the economic turmoil and hyperinflation of the local currency, the bolívar.

As a result, Venezuelan citizens have endured losing nearly all the value of their life savings to hyperinflation. Now, the future of the country remains even more concerning as political tensions rise between the current President, Nicolás Maduro, and the newly elected Juan Guaido claiming the title for himself.

Political conflicts aside for a moment, Venezuelans are turning to cryptocurrency as a viable alternative to the devastating decline in the bolívar. Even before the most recent devaluation of the bolívar, Venezuelans began turning to bitcoin and other cryptocurrencies as a means of storing value. As early as 2014, one Venezuelan bitcoin trader told Reuters:

“Even though bitcoin is volatile, it’s still safer than the national currency.”

Cryptocurrency Solutions

While there’s no denying that bitcoin prices fluctuate greatly, its price movement pales in comparison to the runaway devaluation of the bolívar which hit estimated inflation of 1.37 million percent in 2018.

Cryptocurrencies offer citizens a way of purchasing and storing value that isn’t controlled by a centralized party and Venezuela offers a real-world example where centralization goes awry. Due to capital limitations enforced in the country, it’s increasingly difficult for Venezuelans to get a hold of other fiat currencies like the USD. Cryptocurrencies, on the other hand, remain decentralized and operate agnostic of geographic location, political borders, and government control, meaning anyone and everyone can take advantage of them.

For Venezuelans, cryptocurrencies aren’t a novel concept about the future of the financial world, they’re increasingly becoming a part of daily life. Daily volume for bitcoin in Venezuela is now greater than $1 million per day and consumers are embracing other altcoins like Dash for daily transactions.

Victoria Merchán is the founder of Tradición Gourmet, a restaurant specializing in homemade food in the Venezuelan Capital of Caracas. In an interview with MarketWatch she said:

“Cryptocurrencies, especially Dash, have helped me to have an alternative means of income that, unlike the bolívar is stable and much safer. In addition, it has opened the doors of my business to many more clients and the general public.”

Centralization

Of course, blockchain technology alone isn’t the secret end-all be-all to help citizens circumvent terrible centralized currencies like the bolívar. Similar to the way JPMorgan has created a non-cryptocurrency “cryptocurrency,” so too has the Venezuelan government in the past.

In December of 2017, President Maduro announced the release of a state-issued cryptocurrency, the petro, that was said to be pegged to the country’s oil and natural resources. The petro did not have all the tenets of a typical cryptocurrency and, most importantly, wasn’t decentralized. Because of that, it also brought forth none of the benefits associated with being a cryptocurrency. Instead, the Venezuelan people ended up with yet another centralized attempt at a currency that was nothing more than digital fiat controlled by the government that left more questions than answers.

The Bottom Line

While Venezuela provides one of the best examples of how cryptocurrencies can help people circumvent centralized currencies, it’s not alone. Beyond the hyperinflation of the bolívar, there are many other cases where cryptocurrencies stand as the most viable alternative for transferring value.

In other areas of the world like Sub-Saharan Africa, where cross-border payments average the highest costs according to the World Bank and are potentially holding back economic growth, cryptocurrencies offer a frictionless alternative for commerce. Venezuela and Sub-Saharan Africa are only the beginning as the world looks at other ways of implementing cryptocurrencies.

One factor remains consistent though: decentralization is crucial.

Want to Know More About All the Awesome Stuff We Do?

- Click HERE for instant access to our 2019 Market Report. Explore what 30 thought-leaders from dozens of industry verticals had to say.

- We are advisors and consultants that work with blockchain companies and other transformational technology projects. If you’d like to connect with us on how we can help your company, please click HERE or send us an email at hello@decentranet.com.

- You can also reach out to inquire about any of our current clients or portfolio companies at hello@decentranet.com.