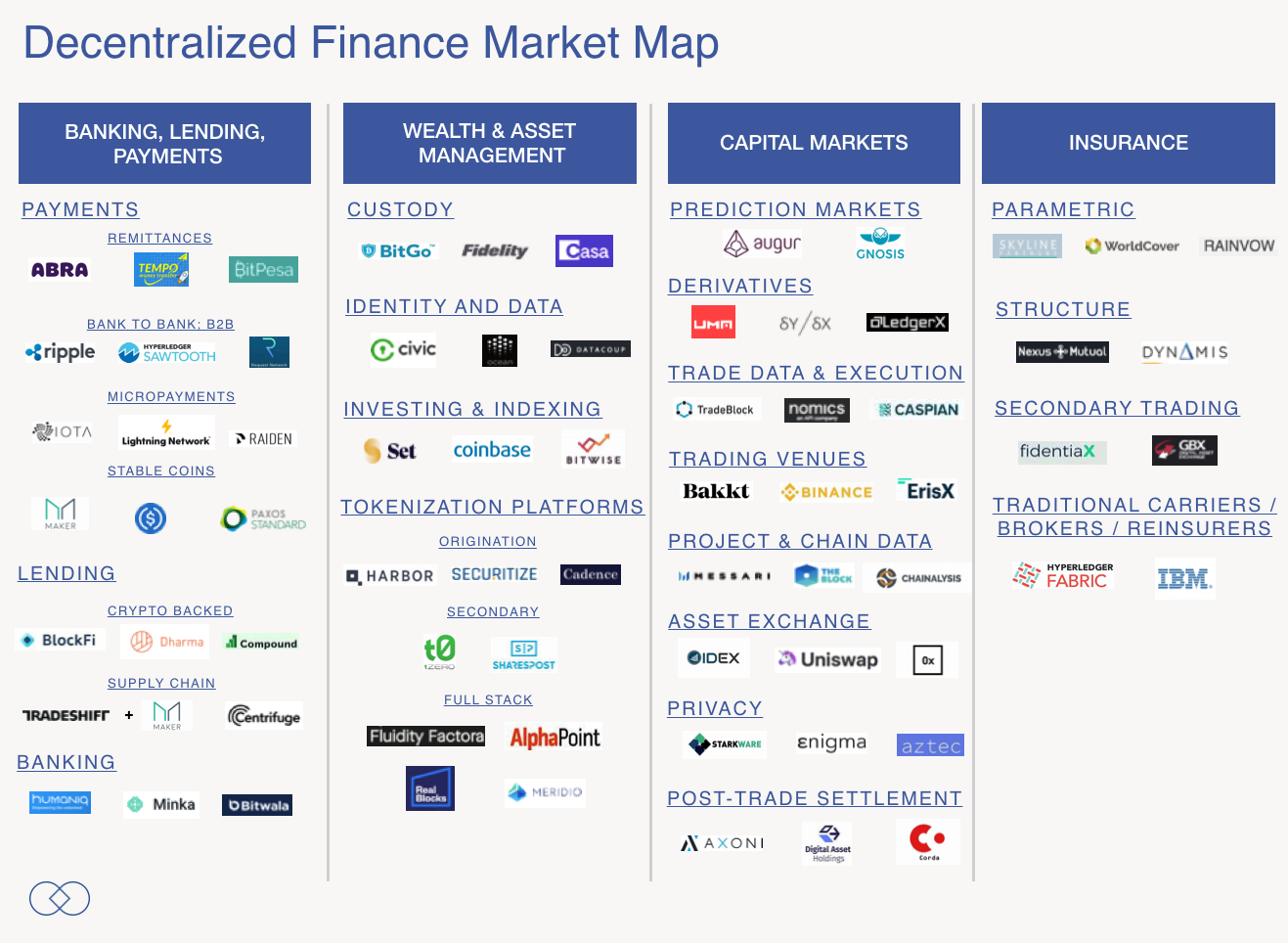

Conventional financial tools built on the blockchain are sparking a blossoming, explosive ecosystem to challenge legacy finance. Here’s why.

TL;DR HIGHLIGHTS

- DeFi is essentially just conventional financial tools built on a blockchain

- One of the most active sectors of blockchain in 2019

- Advances in blockchain technology and a clearer regulatory environment have set conditions for an explosion of innovative finance products

- It is highly likely that more decentralized financial solutions will be created in the near future

In what has become a fitting rallying cry for blockchain enthusiasts everywhere, ‘DeFi’, a clever portmanteau of ‘decentralized’ and ‘finance’, is seriously shaking up the world of traditional centralized financial services. We adopt the following definition of decentralization proposed by Rohit Khare. “A decentralized system is one which requires multiple parties to make their own independent decisions” In such a decentralized system, there is no single centralized authority that makes decisions on behalf of all the parties.

In theory, decentralized finance offers all of the same services and products as the traditional finance world. However, DeFi uses distributed ledger technology, including blockchain, cryptocurrencies, smart contracts, and decentralized applications, to offer services such as loans, financing, and credit arrangements; often without the need for a centralized authority.

As a result, there’s been an explosion of companies seeking venture capital to fund the next wave of decentralized innovation in the financial services industry. These include crypto-asset lending, crypto-backed loans, token leasing services, and blockchain-based banking operators.

Some of these services are simply decentralized versions of their traditional counterparts, albeit with all the virtues of blockchain, such as borderless transfers of value and low transaction fees.

However, self-sustaining digital economies are also beginning to emerge around new ideas such as crypto lending and tokenization of assets — so what might this mean for the world of decentralized finance? First, let’s explore what some of these new concepts are in practice.

Here’s Why the Decentralized Finance Revolution Has Arrived

Peer-to-peer crypto lending is just like regular peer-to-peer lending services, where those who want to earn passive income on their capital can lend their funds to those looking to take a loan, with the lender earning interest in return.

The major difference is that by virtue of blockchain technology, anyone can now loan their capital in return for digital asset collateral to borrowers worldwide. Collateralized assets could include Bitcoin, Ethereum, stable coins like Tether, or even digital collectibles. Although there’s a certain degree of counterparty risk involved in lending peer-to-peer, as the other party could default on their repayments, lenders could use smart contracts to confer themselves some legal protection.

Similarly, crypto-backed loans offered through regulated platforms are also gaining traction. Many blockchain maximalists have the majority of their capital tied up in digital assets, and with the frequent wild swings in the cryptocurrency markets, some investors may be reluctant to exit their positions.

Instead, crypto investors may now borrow fiat against their digital asset holdings. This means that instead of selling their holdings in the event that they need emergency cash, they can instead borrow against them and pay back funds over time.

The Revolutionary Rise

Perhaps for the first time in history, decentralized finance allows trustless and peer-to-peer lending of financial assets. As a result, many platforms are exploring the concept of ‘token leasing’. Token leasing allows simple lending of digital assets, especially non-fungible tokens such as in-game items or collectibles.

Within digital economies, tokens are regularly used by parties either within a platform such as a decentralized application, a web-3 based game or as a way of paying for or accessing decentralized services.

Token leasing is potentially a lucrative way for token holders to make passive income while they hold their digital assets. For those who want to use an asset just to access a service one time or use for a short period, it may be far more cost-effective to lease that asset, rather than buy it and have to worry about price fluctuations and custody options.

As a result, it’s predicted that the token leasing economy will grow alongside the digital asset markets, especially as more decentralized applications and blockchain-based services emerge.

The Largest DeFi Startups to Date

With the growing acceptance of blockchain technology and a clearer regulatory environment, many companies are looking to offer decentralized finance products of their own. This has resulted in a growing number of companies that have been established to meet the burgeoning crypto lending and decentralized banking markets. The largest and most successful of these companies have closed multi-million dollar funding rounds and are now well on track to becoming industry leaders in this emerging financial sector.

One such company, New Jersey-based BlockFi, has just completed its Series A funding round. BlockFi received over US$18 million in investment, including backing by Valar Ventures, a venture capital company formed by PayPal co-founder Peter Thiel; alongside Winklevoss Capital and ConsenSys. BlockFi, and other crypto leasing companies lend borrowers fiat money in return for their crypto as collateral.

Likewise, SALT, another crypto-backed lending startup based in Denver, offers similar services to BlockFi. With over 80 employees to date, SALT offers loans from $5,000, at rates starting from 5.99% APR. Likewise, SALT also offer customers insurance on their digital assets. According to business data aggregation site Pitchbook, SALT has recently attracted $1.5 million in their latest angel investor deal.

Another area of traditional finance which is ripe for decentralization is online banking. Blockchain startup Crypterium, which big four consultancy firm KPMG describes as ‘one of the most promising fintech companies’, is a decentralized banking services provider. Crypterium allows its clients to pay bills, store funds, and spend their digital assets via a physical debit card, all linked and managed through a single app — just like current digital banking solutions. Crypterium launched with a huge initial coin offering, or ‘ICO’, during 2017, which at the time was one of the largest ICOs ever concluded — raising a massive US$51.6 million.

Where digital token-based economies are emerging, new marketplaces and exchanges are being developed to facilitate the transfer and lending of these exciting new assets. Chintai, the first 100% on-chain token leasing exchange to be developed, supports the exchange and lease of virtually any digital asset available, including digital collectibles. Owners of digital assets can generate passive income from their holdings, without ever relinquishing control of their tokens. Chintai has proven its utility by integrating with the EOS mainnet, generating 65,000 EOS as interest for its lenders in just one week at its peak. (Disclaimer: Chintai is a client)

A New Paradigm of Finance?

Because of the potential for DeFi to reach a much wider global market, and the relative ease with which blockchain-based solutions can now be deployed, it’s highly likely that more decentralized financial solutions will be created in the near future.

However, whether DeFi will defy traditional financial solutions, and become a major competitor for market share from existing financial incumbents, remains to be seen. What is perhaps more likely, is that once DeFi technology has matured and become more tested in practice, institutions such as banks, insurance companies, and lenders will launch their own offerings which leverage the power of DeFi technology to their advantage — as we’ve already witnessed with JP Morgan Coin for digital payments.

Therefore, DeFi startups will have to outpace traditional financial providers and rapidly gain market share — before they’re beaten at their own game.