Tokenizing gaming draws parallels with traditional card games such as Magic the Gathering, or digital based card games like Hearthstone.

Since the initial coin offering (ICO) mania of 2017, many people involved in the blockchain space became familiar with the concept of a utility token. In short, utility tokens are units of account that can be used to access services and/or facilitate the functioning of a network. The tokens could fulfill almost any function imaginable, from voting in an election to placing bets in a prediction market. The ICO mania involved the (over)valuation of these networks and services that suddenly became possible thanks to the ability to create these tokens for almost no cost.

One of the most ubiquitous tokens issued for performing tasks or paying fees in blockchain projects, utility tokens can later be used to purchase a good or service offered by the issuer of the cryptocurrency sold utility tokens as a method of fundraising for the start-up.

There are some interesting use cases for blockchain-based tokens which have received comparatively less attention compared to utility tokens, namely non-fungible and semi-fungible tokens (NFTs and SFTs respectively). So, what assets can such tokens potentially represent, and how can they be used?

What is Fungibility?

Firstly, let’s examine the term ‘fungibility’, as it’s an important defining factor for these tokens. Fungibility is the ease in which an asset may be traded against another unit of that same asset.

In cryptocurrency, this covers the overwhelming majority of tokenized or cryptographic assets. For example, one Bitcoin is always equal to another single Bitcoin, and an ERC-20 token can easily be traded for a token of the same type.

However, not all assets are fungible. In the physical world, artwork is a prime example of non-fungibility. If we were to take a piece of museum-grade fine art, such as the Mona Lisa, and compare it to a child’s painting, we may find some superficial similarities. On the most basic level, they are both paintings, they may use similar materials, and they may be around the same size. But it is other, critical characteristics of those paintings, such as the artist, age, and subjective beauty which make them non-fungible; impossible to meaningfully compare or trade with each other in real life. This is where non-fungible and semi-fungible tokens enter into the equation.

What is a ‘Non-Fungible’ Token?

Instead of tokens which hold or represent identical value, non-fungible tokens (NFTs), may appear similar, but each one represents an item with unique characteristics distinct from other assets. For example, if you own Bitcoin or Ether, you may not care which specific unit you have, as long as you have 1:1 equal units. Non-fungible tokens, however, are unique, so it does matter which one you have.

This has powerful utility when it’s programmed into a token, as it allows items, such as in-game digital assets or collectibles, to be represented as an actual asset for the first time in gaming history.

So, what does this mean for gamers and the future of gaming? By tokenizing their virtual property, it becomes a tangible and immutable asset stored on the blockchain, which means players can prove ownership, trade, and sell their items which they’ve earned in the virtual world. Gamers can then exchange assets with each other or transfer them from game to game, placing a high value on the in-game properties.

Game developers could integrate smart contracts and non-fungible assets to enhance their item infrastructure and generate new streams of revenue. Non-fungible tokens can be used to create transparent digital scarcity, stimulate player engagement, and allow secure and monetizable ownership of assets.” Chris Gonsalves, Hacker Noon

With an increased focus on ‘freemium’ business models, where game developers offer free-to-play games that instead generate revenue through in-game purchases, it’s expected that digital in-game economies will flourish, with 66% of surveyed gamers in the UK already purchasing virtual goods on a regular basis.

Certain games, such as CryptoKitties, the infamous virtual cat-collection game which crashed the Ethereum network, use NFTs to represent differences between collectible ‘cards’, each representing a cat with unique features, rarity, and appearance. This draws parallels with traditional card games such as Magic the Gathering, or digital based card games like Hearthstone.

This innovation in the way digital items are represented is giving rise to new marketplaces for the exchange and lending of NFTs and digital goods. EOS based Chintai, for instance, is a fully functional decentralized resource exchange which enables users to lease their digital assets within a peer-to-peer decentralized economy. There is a path forward where gamers who have spent time gaining the best equipment could effectively earn passive income from loaning their in-game items to other players.

“We’re building the decentralized engine for digital items collecting dust to be used by anyone who needs them, and driving passive income to their original owners. Want to lease an item to complete a level, or explore a game in a new way? Chintai will facilitate that process. Activating fun experiences with this potent win-win economy is what we’re after,” says Ryan Bethem with Chintai

What is a ‘Semi-Fungible’ Token?

There are of course assets which exist in a grey zone between fully fungible, and entirely non-fungible. These assets may be incredibly similar or deliver the same end-result or product, but have subtle differences which would be best represented as a semi-fungible token (SFT).

A perfect example of a candidate for SFTs is airline seats. Each airline seat is physically the same, and all the seats aboard a flight obviously arrive at the same destination. However, some passengers may prefer an aisle seat, some may choose more legroom, and some travelers may wish to be seated at the back of the plane.

These are all subtle changes, compared to the differences between two pieces of original artwork for example, but nevertheless, they require greater definition coded into their respective token, and they couldn’t be easily exchanged 1:1 without some compromise. A similar scenario arises with concert seating, and SFTs can also represent the scarcity of a particular asset or group of items.

What Else Could be Tokenized?

As we’ve discussed, art is a prime case for tokenization. Fine art pieces worth substantial sums of money are prized assets for their owners, however, they have traditionally lacked liquidity.

Through tokenization, owners could release equity in their art piece to other investors, who would own a provable stake in that piece of fine art. The same is true for other unique assets, such as vintage wine, premium real estate, or jewelry, and the use cases for NFTs and SFTs are numerous.

The Future of Digital Item Ownership?

As the adoption of NFTs and SFTs grow, the potential for an entirely new class of digital assets is emerging. For gamers, this represents one of the first times they can truly own and transact their hard-earned in-game items via a decentralized network; rather than residing on game providers’ centralized servers, and at the mercy of a third-party provider.

Therefore, digital collectibles, in-game items, and other virtual assets represent one of the most exciting use cases for NFTs, with a host of applications still to be explored. Likewise, it’s expected that as this nascent industry grows, tailored marketplaces for digital asset sales and lending will emerge, to integrate or replace in-game marketplaces, and allow cross-platform transfers of sought-after digital items.

Want to Know More About All the Awesome Stuff We Do?

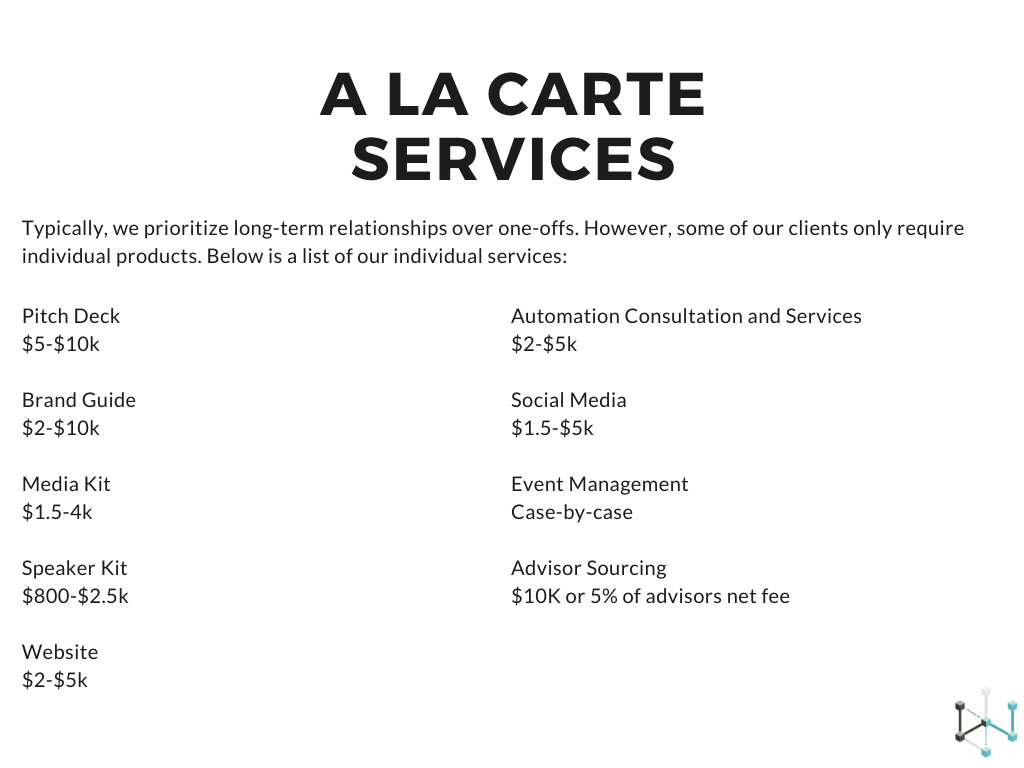

DecentraNet is a purpose-driven investment and advisory firm specializing in blockchain and other transformational technologies with global impact. We also create event experiences and innovative content to bring our clients projects to market and to evangelize the potential of transformational technologies generally.

- Click HERE for instant access to our 2019 Market Report. Explore what 30 thought-leaders from dozens of industry verticals had to say.

- We are advisors and consultants that work with blockchain companies and other transformational technology projects. If you’d like to connect with us on how we can help your company, please click HERE or send us an email at hello@decentranet.com.

- You can also reach out to inquire about any of our current clients or portfolio companies at hello@decentranet.com.