Stablecoins are a type of cryptocurrency which keep their value at a constant ‘peg’, usually a 1:1 ratio with another asset such as a traditional fiat currency. Here’s why this is important.

Stablecoins are cryptocurrencies designed to minimize the volatility of the price of the stablecoin, relative to some “stable” asset or basket of assets. A stablecoin can be pegged to a currency, or to exchange traded commodities (such as precious or industrial metals). Most stablecoins in use today are pegged to the U.S. dollar, through what is known as a ‘trust coin’. Trust coins are traded on the basis that the issuing party has sufficient funds in their account to act as collateral against all circulating stablecoins.

However, as the nascent cryptoasset industry evolves side-by-side with traditional financial products, new stablecoins are being created. Newcomers include commodity coins, algorithmic coins, and bank coins. Some long-standing stablecoins are experiencing operational difficulties as new competitors enter the market.

So, what is the state of the stablecoin market today, and where could these useful and stable cryptocurrencies be heading in the future?

Bitfinex and Tether

Those who have been paying close attention to cryptocurrency news in recent weeks have likely read about the unfolding situation with highly-traded U.S. dollar backed stablecoin Tether (ticker symbol: USDT), created and issued by cryptocurrency exchange Bitfinex.

It was found that in contrary to the initial promises of Bitfinex, which read: “Every tether is always backed 1-to-1, by traditional currency held in our reserves. So, 1 USDT is always equivalent to 1 USD.”, Tether later amended their token description to read: “every tether is always 100% backed by our reserves, which include traditional currency and… from time to time, may include other assets and receivables from loans made by Tether to third- parties”, prompting some users to wonder if USDT was backed by tangible assets at all.

This crucial change in terms came after a 23-page document was issued by The New York State Attorney General (NYSAG) on April 24th, 2019, accusing Tether of using their reserves, meant to collateralize circulating USDT, to instead cover a loss of US$850 million, incurred during a suspected abscondment by payment partner Crypto Capital.

Likewise, it has recently emerged that Tether, used primarily by traders to circumvent the volatility of other cryptocurrencies, has in fact been making investments into bitcoin with their reserves, a contrasting strategy to their status as a stablecoin.

Although Bitfinex asserted in a recent press release that the claims brought against Tether are erroneous and that both Bitfinex and Tether are ‘financially strong’, many cryptocurrency experts, including Ethereum co-founder Joseph Lubin, have expressed doubt that Tether will recover; with Lubin adding that other price-stable tokens will likely gain traction because of the Tether situation.

New Stablecoin Competitors

As the cryptocurrency markets mature, and traders require more advanced products to provide stability and safe stores of value in periods of market volatility, many new stablecoins are emerging which seek to challenge Tether’s position in the top 10 cryptocurrencies by market cap.

One such competitor which is gaining serious traction among traders, is U.S. dollar backed Gemini stablecoin (ticker symbol: GUSD), the world’s first regulated stablecoin. The Gemini coin was launched in 2018 by the billionaire Winklevoss twins.

To avoid such debacles as have been unfolding with Tether, the Gemini stablecoin is subject to a monthly third- party audit by public accounting firm BPM LLP, to confirm it still holds its 1:1 peg with the dollar. As a statement on transparency, Gemini has made all their reports publicly available.

In a recent press release, cryptocurrency payment network Flexa announced that it would be partnering with Gemini to enable instant cryptocurrency payments, including the Gemini dollar, in stores and online for a range of huge retail merchants, including international coffee chain Starbucks.

New stablecoins entering the market, which challenge the status quo through strong innovation and partnerships, could seriously challenge USDT’s market share, especially at a time when controversy has Tether and Bitfinex under the spotlight.

Emerging Stablecoin Technology

Other forms of stablecoins are also being experimented with, which don’t simply work on a trust coin model. Bank coins, such as J.P. Morgan’s new ‘JPM coin’, is a type of stablecoin for institutional clients, which is USD-backed like a trust coin, but held in custody in J.P.Morgan accounts and therefore verifiable. These coins are set to facilitate instantaneous cross-border payments via blockchain technology.

Furthermore, algorithmic stablecoins, often abbreviated as ‘algo-coins’, use a novel type of peg to maintain their value. Instead of relying on real assets or fiat to back coins, algo-coins are coded with specific sets of rules which govern their behavior and value.

For example, some algo-coins auto- adjust their supply as demand increases or declines for the stablecoin, which subsequently affects price. The most notable example where this has been tried before is Basis, an algorithmic stablecoin which raised US$133 million that sought to create an inflation resistant stable digital currency.

Unfortunately, the project fell under the scope of US securities regulations, making it prohibitively expensive to be in compliance, and was forced to be shelved in December 2018.

The Future and Limitations of Stablecoins

It seems obvious that there are improvements to be made, especially with trust coins, with verifying that the stablecoin issuer actually has the funds or assets to back their stablecoins on a 1:1 basis.

Issuers like Gemini have realized this and are now competing by implementing independent third-party auditing services to reassure their users that funds are backed. Before, with stablecoins like Tether, it would have been impossible for the average user to verify that Bitfinex held adequate funds.

Likewise, centralization of stablecoin assets is a persistent issue which requires a solution. Many have criticized the JPM coin as being a centralized stablecoin which detracts from the founding principles of decentralized blockchain technology, however, other popular stablecoins such as Tether are also virtually in the sole control of a central issuing authority.

As a means of payment, transacting across borders, and as a ‘safe-haven’ during volatile trading periods, the stablecoin is a valuable tool with a multitude of applications. As the space matures, it’s highly likely that many new innovative stablecoins will emerge to challenge today’s leading coins.

Want to Know More About All the Awesome Stuff We Do?

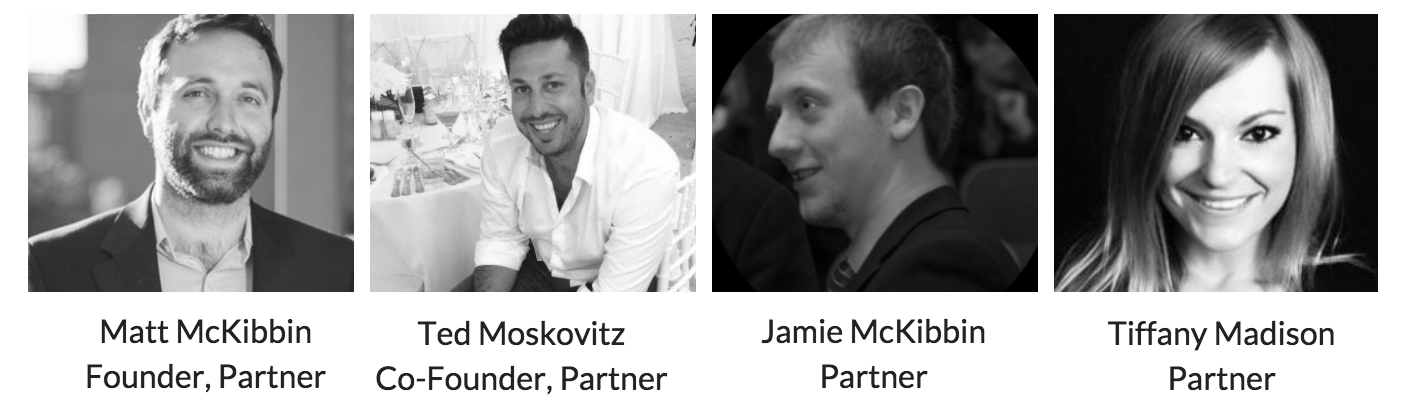

DecentraNet is a purpose-driven investment and advisory firm specializing in blockchain and other transformational technologies with global impact. We also create event experiences and innovative content to bring our clients projects to market and to evangelize the potential of transformational technologies generally.

- Click HERE for instant access to our 2019 Market Report. Explore what 30 thought-leaders from dozens of industry verticals had to say.

- We are advisors and consultants that work with blockchain companies and other transformational technology projects. If you’d like to connect with us on how we can help your company, please click HERE or send us an email at hello@decentranet.com.

- You can also reach out to inquire about any of our current clients or portfolio companies at hello@decentranet.com.